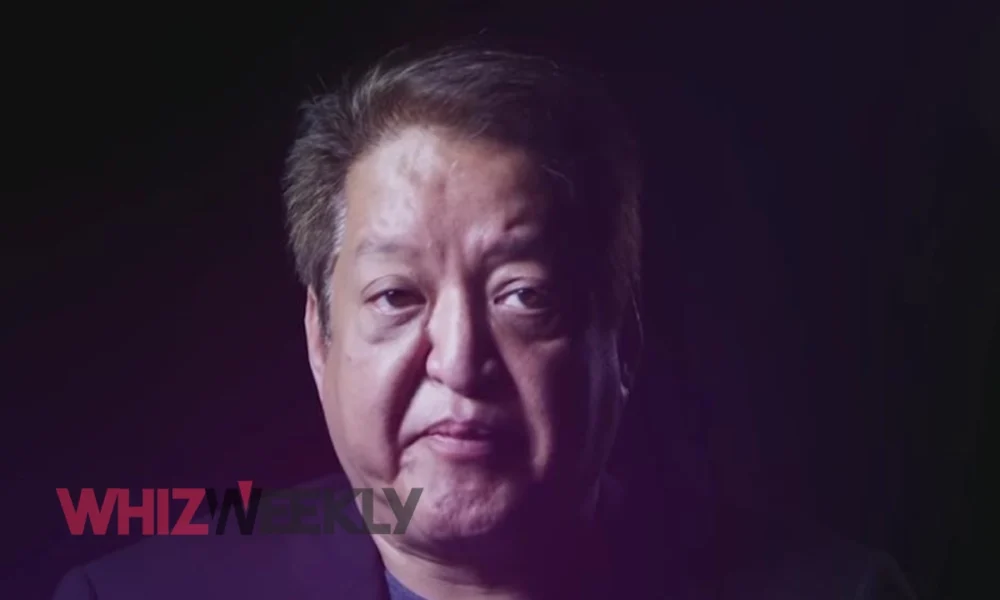

Terrance Watanabe Net Worth: From $500M Fortune to Financial Collapse

Terrance Watanabe net worth peaked at $500 million after building Oriental Trading Company into a $300 million annual revenue business. He lost approximately $204 million through gambling, primarily in 2007, representing the largest single-year casino loss in Las Vegas history. His current net worth is negligible.

Who Is Terrance Watanabe?

Terrance Watanabe built one of America’s most successful party supply companies before becoming famous for the worst reason possible. He transformed Oriental Trading Company from a small gift shop into a $300 million annual revenue mail-order empire, only to lose most of his fortune at casino tables.

Born in Nebraska in 1957, Watanabe inherited the Oriental Trading Company from his father, Harry, a Japanese immigrant who founded the business in 1932. His story represents one of the most dramatic financial collapses in modern business history.

The numbers tell a stark tale. Terrance Watanabe net worth reached approximately $500 million at its peak, but he ultimately lost over $204 million due to gambling addiction. Today, his wealth has essentially disappeared.

Building the Oriental Trading Empire

Watanabe’s father asked him at age 15 if he wanted to take over the family business, following Japanese tradition. He officially assumed control at age 20 in 1977, becoming president and part-owner.

His business instincts proved exceptional. The company shifted focus from carnival trinkets to serving churches, schools, retailers, and individual consumers. This strategic pivot generated massive growth and significantly increased Terrance Watanabe net worth during his tenure.

Under his leadership, Oriental Trading Company expanded beyond physical stores to embrace the mail-order model, reaching customers nationwide without additional retail overhead. By 2000, the company generated $300 million in annual revenue and employed hundreds at its Omaha headquarters.

The Life-Changing Sale

In 2000, Watanabe sold his entire stake to Brentwood Associates, a Los Angeles-based private equity firm. The sale provided him with substantial liquidity estimated in the hundreds of millions of dollars. He stepped down as CEO and president, ending his 23-year tenure.

The company changed hands multiple times after his departure. In 2006, the Carlyle Group acquired a 68% stake. By 2010, Oriental Trading Company filed for Chapter 11 bankruptcy protection. In 2012, Warren Buffett’s Berkshire Hathaway acquired the company, where it remains today.

The Descent Into Gambling

After cashing out, Watanabe began gambling at Harrah’s Council Bluffs casino near his Omaha home. By 2005, he had graduated to the Las Vegas Strip, and his gambling habits intensified dramatically.

His game choices showed poor strategy. He favored blackjack, roulette, and slot machines—games with some of the worst odds for players. He was frequently intoxicated, sometimes gambling for 24 hours straight while playing up to three $50,000 blackjack hands at once.

Casinos encouraged his addiction with extraordinary perks. Harrah’s gave him a 15% rebate on large losses, $12,500 monthly in airfare credits, and $500,000 in gift shop credit. They created a special “Chairman” tier status for him in their rewards program.

The Historic $204 Million Loss

The year 2007 marked a financial catastrophe. Watanabe reportedly gambled $825 million and lost $127 million at Caesars Palace and the Rio. After internal records were reviewed during legal proceedings, the final estimated loss approached $204 million, making it the largest single-year gambling loss by one person in Las Vegas history.

At peak addiction, he lost up to $5 million per day. His losses became so significant that his presence accounted for 5.6% of Harrah’s total annual gaming revenue in Las Vegas that year. No other individual gambler had ever contributed such a large percentage to a major casino company’s income.

2007 Gambling Statistics:

| Metric | Amount |

|---|---|

| Total Wagered | $825 million |

| Net Loss | $204 million |

| Daily Loss (peak) | $5 million |

| Percentage of Harrah’s Revenue | 5.6% |

Legal Battles and Criminal Charges

Watanabe eventually paid back $112 million of his debts but refused to cover the remaining $14.7 million. Harrah’s filed a criminal complaint in 2009, accusing him of fraud and writing bad checks. These felony charges carried potential prison time.

Watanabe fought back with serious allegations. He claimed that Harrah’s enabled his addiction by serving him alcohol and prescription drugs while he was visibly impaired. His legal team argued the casinos violated Nevada gaming regulations.

Caesars Entertainment was fined $225,000 by the New Jersey Gaming Commission for allowing him to gamble while heavily intoxicated. The case was dismissed in 2010, and both sides reached a confidential settlement during arbitration.

Current Financial Status

Terrance Watanabe’s net worth today bears no resemblance to his former wealth. Multiple indicators show complete financial devastation.

He sold his Omaha mansion in 2008 for $2.66 million and moved to San Francisco. The clearest evidence came in 2017 when he launched a GoFundMe campaign to raise money for cancer surgery, revealing that his $500 million fortune had essentially vanished.

Financial experts estimate Terrance Watanabe net worth is negligible today. The gambling losses, combined with probable tax obligations and legal fees, consumed virtually everything.

Financial Timeline:

| Year | Event | Financial Impact |

|---|---|---|

| 2000 | Company sale | Terrance Watanabe net worth peaks at $500M |

| 2007 | Record gambling loss | Lost $204M |

| 2008 | Property sale | Sold mansion for $2.66M |

| 2017 | Medical crowdfunding | Launched a GoFundMe campaign |

Recovery and Life After Gambling

Following an intervention by his family in late 2007, Watanabe entered residential rehab and reportedly has not gambled since. He completed the inpatient program successfully.

His prostate cancer diagnosis in 2017 created additional difficulties, given his reduced financial resources. The public fundraising campaign highlighted both health struggles and financial limitations.

In 2022, media company Foundation Media Partners acquired the rights to his life story with plans for a film, book, and documentary. Watanabe maintains a low public profile today. His story serves as a case study in addiction psychology and responsible gaming practices.

Conclusion

Terrance Watanabe’s story represents one of the most dramatic reversals of fortune in American business history. Terrance Watanabe net worth of $500 million represented decades of hard work and smart business decisions.

Yet within just a few years after selling his company, virtually all of it disappeared at casino tables. His $204 million gambling loss remains the largest by an individual in Las Vegas history.

Today, Watanabe lives quietly, having overcome his addiction but lost his fortune. The lessons from his experience remain relevant for anyone managing sudden wealth or facing addiction challenges.

FAQs

What was Terrance Watanabe’s peak net worth?

Terrance Watanabe net worth peaked at approximately $500 million following the 2000 sale of Oriental Trading Company to Brentwood Associates.

How much did Terrance Watanabe lose gambling?

He lost approximately $204 million through gambling, primarily during 2007, representing the largest single-year gambling loss by an individual in Las Vegas history.

What is Terrance Watanabe’s net worth today?

His current net worth is likely negligible. His 2017 GoFundMe campaign for cancer surgery indicates his fortune had essentially disappeared.

Does Terrance Watanabe still gamble?

Following family intervention in late 2007, Watanabe entered residential rehab and reportedly has not gambled since completing treatment.

What happened to Oriental Trading Company?

After Watanabe sold the company in 2000, it changed ownership multiple times and filed for bankruptcy in 2010. Berkshire Hathaway acquired it in 2012.